Factors such as rising EV sales worldwide will increase demand for EV charging stations, government policies and subsidies to support faster setup of EV charging stations, limited driving range boosting need for extensive charging infrastructure, reducing price of EVs in global market will boost EV sales and EVCS demand. These factors propel the development and expansion of EV fast charger, facilitating the widespread adoption of electric vehicles and the establishment of a sustainable transportation ecosystem.

Shift in NACS Standards in the US Expected to Accelerate Demand for Tesla Superchargers.

The adoption of the North American Charging Standard (NACS) in the United States is set to accelerate demand for Tesla Superchargers. These chargers are designed to work with various electrical systems and feature automatic support for both AC and DC charging. They can add up to 200 miles of range in just 15 minutes, making them highly efficient. With over 55,000 Supercharging points globally and rapidly expanding networks, Tesla is enhancing accessibility, including a pilot program in the Netherlands open to non-Tesla vehicles. Tesla adjusts pricing periodically to support network growth, and urban installations are strategically located for convenience. It also offers 400 kWh of free Supercharger credit annually to Model S and Model X owners. While most electric vehicle manufacturers in North America currently use the SAE J1772 connector, Tesla has transitioned to open standards like NACS, with major manufacturers planning to adopt unified connectors in the future. Charging providers are integrating NACS options into their offerings, and leading automakers like Volkswagen, GM, and Ford in the US have partnered with Tesla to enable compatibility with NACS-enabled vehicles in the US.

Increasing Demand for DC Ultra-Fast 2 Chargers Expected with Rising Need for Fast-Charging Solutions.

The increase in demand of EV charging solutions has persisted due to the imperative of reducing charging durations. Ultra-fast charging has been developed to address this demand, requiring EVs equipped with batteries capable of handling ultra-fast 2 charging, operating within optimal temperature ranges. This method can fully charge an EV within approximately 5-10 minutes. Leading companies involved in ultra-fast charging installations include ABB, Delta, Tritium, and EVBox. ABB introduced the world’s first 360 kW charger in 2022. Likewise, in February 2024, Chaevi (South Korea) unveiled its latest 400 kW Tesla NACS-compatible DC fast charger, equipped with dual ports for simultaneous charging, supporting CCSI and/or NACS connector configurations. Leading Charging Point Manufacturers (CPMs) have begun deploying 400 kW chargers since late 2023; Mercedes-Benz, for instance, installed its initial 400 kW chargers in the US in October 2023. Similarly, Vital EV Solutions installed the UK’s premier 400 kW DC ultra-fast 2 chargers. Initially utilized primarily for commercial vehicle rapid charging, ultra-fast 2 charging has found application in passenger cars as well. Various countries are already planning the deployment of these charging stations along highways. In the UK, EON Energy (Germany) and GRIDSERVE (UK) have erected such charging stations along highways. Siemens (Germany) and ARAL (Germany) have deployed charging stations across Germany. Fastned has also installed these chargers across the UK, Germany, and France. IONITY (Germany) has established similar charging points across Europe. Tritium (US), Electrify America (US), and ABB (Switzerland) have also erected Ultra-fast level 2 chargers in the US.

Increasing Demand for Fixed EV Chargers to Drive Market.

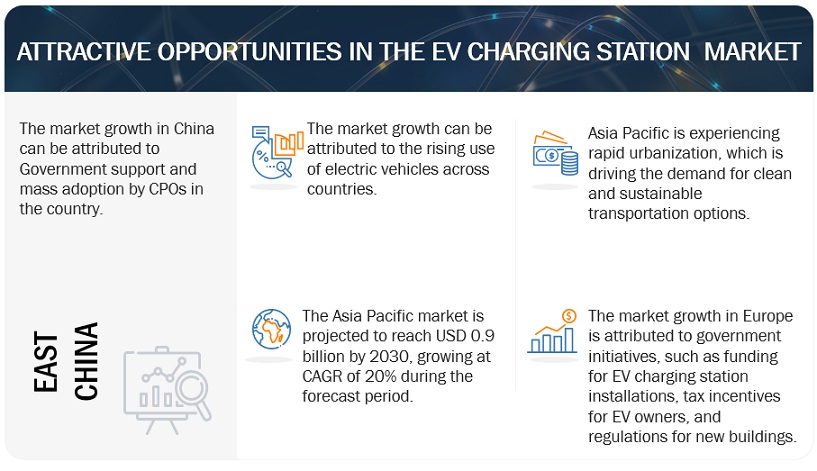

Fixed chargers, also known as charging stations, are stationary infrastructure essential for electric vehicles (EVs). Placed in public areas, highways, malls, and offices, they require EV owners to bring their vehicles for charging. Despite higher initial costs compared to portable chargers due to infrastructure needs, fixed chargers offer faster charging rates. Governments collaborate with OEMs to deploy fixed chargers, supported by subsidies and incentives to promote EV adoption and reduce carbon emissions. Fixed chargers provide economic benefits and quicker charging rates, driving market growth amid the transition to electric vehicles. China is expected to be the largest as well as the fastest growing in fixed charger segment, by installation type. South Korea, Germany, Netherlands, France, US etc. are among the other leading countries in the fixed charger segment. In Europe and Asia Pacific, governments of leading EV-using countries granted incentives for the adoption of EV vehicles and the installation of EV chargers, which is expected to increase the demand for fixed chargers.

Key Players

The major players in EV Charging Station market include ABB (Switzerland), BYD (China), MIDA(China), ChargePoint (US), Tesla (US), Siemens (Germany), among others. These companies offer EV Charging stations and solutions for OEMs as well as for Charge Point Operators and have strong distribution networks across the globe.

Market Dynamics:

Driver: Government policies and subsidies to support faster setup of EV charging stations

The increasing global demand for EVs is expected to drive up the need for charging infrastructure, with governments worldwide funding its development and offering subsidies. Favorable policies incentivize the installation of charging stations, often accompanied by incentives such as reduced fees and taxes. Many countries have committed to expanding EV charging infrastructure alongside their EV transition plans. Both public and private investments, like US plans to deploy 500,000 new charging outlets by 2030, contribute to growth. Innovations such as high-speed charging stations and wireless systems have emerged from private sector investments. Tackling these challenges requires a collaborative approach involving policy incentives, technological advancements, and education campaigns. In the EU, initiatives like the European Green Deal and the Fit for 55 package aim to support electric mobility and reduce carbon emissions. Similarly, the National Electric Vehicle Infrastructure (NEVI) Formula Program in the US is introducing regulations to enhance the efficiency and accessibility of EV charging networks. Government financial support, such as subsidies for installing charging stations , further stimulates growth in the EV charging station market, prompting automakers to shift their focus towards electric vehicles.

Restraint: Lack of standardization of charging infrastructure

The absence of standardized electric vehicle (EV) charging infrastructure has become increasingly apparent due to factors such as the expanding EV market and varying charging requirements. Certain EV charging stations may only support specific voltage types. For instance, AC charging stations offer 120V AC via level 1 charging and 208/240V AC via level 2 charging, while DC charging stations provide rapid charging at 480V AC. Various countries adhere to different fast charging standards, with Japan utilizing CHAdeMO, Europe utilizing CCS 2, the US, and South Korea employing CCS 1, and China utilizing GB/T.

Opportunity: Use of V2G-enabled EV charging stations for electric vehicles

Vehicle-to-Grid (V2G) EV charging represents a system facilitating bi-directional electrical energy exchange between plug-in EVs and the power grid. One of the primary advantages of V2G charging stations lies in grid balancing. By enabling electric vehicles to feed power back into the grid during peak demand periods, V2G charging stations contribute to grid stability, potentially obviating the need for costly infrastructure upgrades. This could translate into reduced consumer energy expenses and a more resilient grid infrastructure. Additionally, V2G charging stations offer energy storage capabilities. Electric vehicles serve as mobile energy storage units, providing backup power to residences and businesses during outages or emergencies. This enhances energy resilience and diminishes reliance on diesel generators or other backup systems. Moreover, V2G charging stations have the potential to lower energy costs.

Challenges: Significant dependence on fossil fuel electricity generation & limited production in developing countries

Numerous countries continue to rely on fossil fuels for electricity generation, leading to significant environmental pollution. However, the limited sustainability of these fuels for long-term power generation, coupled with lower grid capacity from such power plants, is expected to hinder the widespread adoption of electric vehicles (EVs) in many nations in the coming decades. For instance, India generates approximately 60% of its electricity from fossil fuels, including coal and lithium, while the United States relies on fossil fuels for a similar percentage of its electricity production. In contrast, Europe utilizes fossil fuels for only about 35-40% of its electricity generation. To address this challenge, countries will need to undertake extensive updates to their power generation infrastructure and transition towards more environmentally efficient methods of electricity production. The continued reliance on fossil fuels for electricity generation contradicts the goal of transitioning to EVs from traditional internal combustion engine (ICE) vehicles and presents a significant obstacle for countries striving to reduce emissions over the long term.

Market Ecosystem

“DC Ultra-fast 1 charger segment is estimated to hold a significant share of EV Charging Station market during the forecast period.”

The segment for ultra-fast 1 chargers is expected to expand rapidly, supported by growing demand and OEMs offering compatible EVs. The surge in demand for High Power Charging Stations (HPCS) is boosting the development of faster charging infrastructure, with stations capable of delivering a full charge within 10-20 minutes becoming increasingly popular. Major players like ABB and Tesla are leading the charge, with Tesla upgrading its superchargers to 250 kW and planning further upgrades to 300 kW. Electrify America recently inaugurated a flagship indoor station in the US. While demand for ultra-fast chargers is growing, they are primarily used for specific cases due to their higher cost and concerns about battery degradation over time.

“Three-Phase Charger segment expected to be the largest segment during the forecast period.”

The increasing demand for fast charging is driving the market for three-phase electric vehicle (EV) chargers, offering power outputs up to 43 kW AC and 350 kW DC. Government initiatives, such as plans for millions of chargers by 2030 and specific mandates like one DC charger per 60 kilometers in the US, are fostering EV adoption. Advancements in EV technology are making electric vehicles more accessible and affordable, further boosting demand. Three-phase chargers with advanced safety features are ideal for public charging stations and parking lots. They offer rapid charging speeds, significantly faster than single-phase chargers, appealing to users seeking quick recharging times. As EV adoption grows, the need for charging infrastructure is increasing, with three-phase chargers playing a critical role.

“China is estimated to be the largest market during the forecast period.”

The China region is poised to become the largest market for EV Charging Station by 2030, The growth of the EV charging station market in China is propelled by several key factors. The government’s implementation of the Green Car Credit system and generous incentives for expanding the EV charging network have significantly boosted market expansion. Moreover, rapid advancements in charging infrastructure facilitate the accessibility and efficiency of charging stations across the nation. China is investing significantly in the production of EV charging stations to provide charging solutions for the increasing number of EVs in the country. OEMs such as BYD also plan to establish production plants worldwide to manufacture electric buses and trucks to meet demand. Additionally, the rising demand for fast-charging solutions within the region further stimulates market growth, reflecting consumers’ evolving preferences towards convenient and speedy charging options for their electric vehicles. EV Battery prices started falling to half in 2024, which is expected to drive EV sales and EVCS setup in coming years. Leading CPOs in China like StarCharge, Stategrid among others are having high setup rate, but low utilization rate. For instance, StarCharge, which is the second biggest public charging network in China, with over 419,000 charging points. Each of these charging points uses only about 40 kilowatt hours (kWh) of power per day. This means that on average, each charger is used for less than two hours a day, with a daily utilization rate of 8 percent.

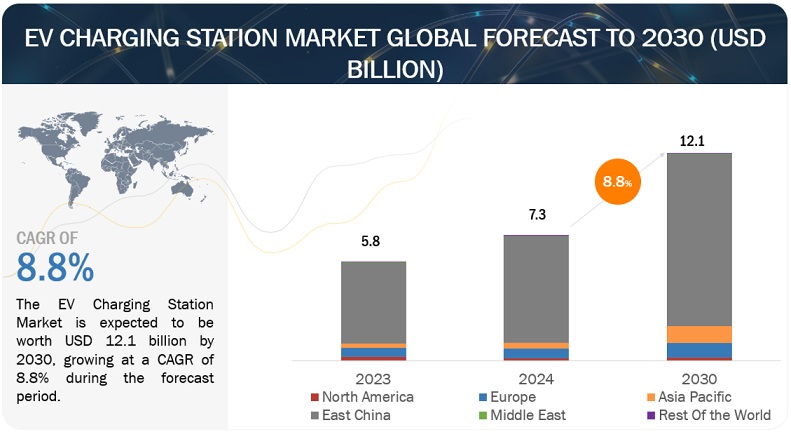

What is the current size of the global EV Charging Station market?

The global Ev Charging Station market is projected to grow from UsD 7.3 bilion in 2024 to UsD 12.1 bilion by 2030, at a CAGR of 8.8%

Who are the winners in the global EV Charging Station market?

The Ev Charging station marketis dominated by major OEMs, includingAB8 (Sswizerand, ium (Australa), BYD (china), MIDA(China), chargePoint (uS), Tesla uS), and charge Point peralorsincuding bp (uk),Shell (UK), ENGlE (France) and Total Energies (France).

Which region will have the largest market for EV Charging Station?

The China region will have the largest market for Ev charging Station due to government’s support to Green car credit system and high incentives for Ev Charging Network in the region.

Which country will have the significant demand for EV Charging Station in Europe region?

Germany will be a significant market for EV Charging Stations. Government incentives and the presence of large number of CPOs such as EnBW, Shell, and Ionity, among others,will increase the demand in Germany.

What are the key market trends impacting the growth of the EV Charging Station market?

Megawatt Charging System (Mcs), Induction charging, vehicle-to-Grid(V2G) Technology, and wireless charging are the key market trend or technologies that will have a major impact on the Ev charging Station market.

Post time: May-08-2024